5 Best Silver ETFs

Person, that you are not seeking to purchase an investment product for the account or benefit of a U.S. Person and that you shall only distribute the materials contained in this website to non-U.S. Persons, and in compliance with all applicable laws and regulations of the relevant jurisdiction in which such materials will be distributed. Person” includes, but is not limited to, any natural person resident in the U.S. and any partnership or corporation organized or incorporated under the laws of the U.S. Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable.

As its use is rare when compared to other industrial metals, its value is primarily derived from long-term investors looking for a way to ride out a down market. Investing in silver usually entails allocating capital towards silver bars or coins, the direct production of silver, silver mining companies, or through exchange traded funds (ETFs). Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Certain sectors and markets perform exceptionally well based on current market conditions and iShares and BlackRock Funds can benefit from that performance.

Inclusion of Sustainability Characteristics is not indicative of a fund’s investment objective, nor is it an implication that a fund employs an ESG-related portfolio management strategy. Please refer to the MSCI ESG Fund Ratings Methodology for more information. This website contains information intended only for financial intermediaries acting as agents on behalf of non-U.S. By accessing the website, you certify that you are a financial intermediary acting as an agent on behalf of a non-U.S.

The iShares Silver Trust is one of the ETFs administered by BlackRock. Each share of the fund represents a fractional undivided beneficial interest in the net assets of the iShares Silver Trust. SLV has a relatively low annual expense ratio of 0.5% when compared to its ETF peers from the precious metals sector. Brokerage costs for the fund to buy and sell shares are not part of the expense ratio. The shares of SLV are traded on the New York Stock Exchange Arca, and investors can purchase them like any other stock. Index performance returns do not reflect any management fees, transaction costs or expenses.

News iShares Silver TrustSLV

Commodity ETFs such as SLV may be particularly risky as the price of precious metals can be impacted by changes in overall market movements, underlying index volatility, changes in interest rates, or factors affecting a particular industry or commodity. Neither party should be liable to the other for any loss or damage which may be suffered by the other party due to any cause beyond the first party’s reasonable control including without limitation any power failure. As a result of money laundering regulations, additional documentation for identification purposes may be required when investing in a fund referred to on this website. Details are contained in the relevant fund’s offering documents.

Shares of SLV Now Oversold – Nasdaq

Shares of SLV Now Oversold.

Posted: Thu, 14 Sep 2023 14:50:00 GMT [source]

Share Class and Benchmark performance displayed in USD, hedged fund benchmark performance is displayed in USD. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. You may leave this website when you access certain links on this website. BlackRock has not examined any of third-party websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

The Paying Agent of the Fund is State Street Bank International GmbH, München, Zweigniederlassung Zürich. Once you have confirmed that you agree to the legal information in this document, and the Privacy Policy – by indicating your consent above – we will place a cookie on your computer to recognize you and prevent this page reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information. Please note that you are required to read and accept the terms of our Privacy Policy before you are able to access our websites. If you are uncertain as to whether you can be classified as an institutional, professional or qualified investor under the applicable rules of your jurisdiction of residence, then you should seek independent advice.

Holdings Comparison

Indexes are unmanaged and one cannot invest directly in an index. Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. The information contained on this website is published in good faith but no representation or warranty, express or implied, is made by BlackRock or by any person as to its accuracy or completeness and it should not be relied on as such.

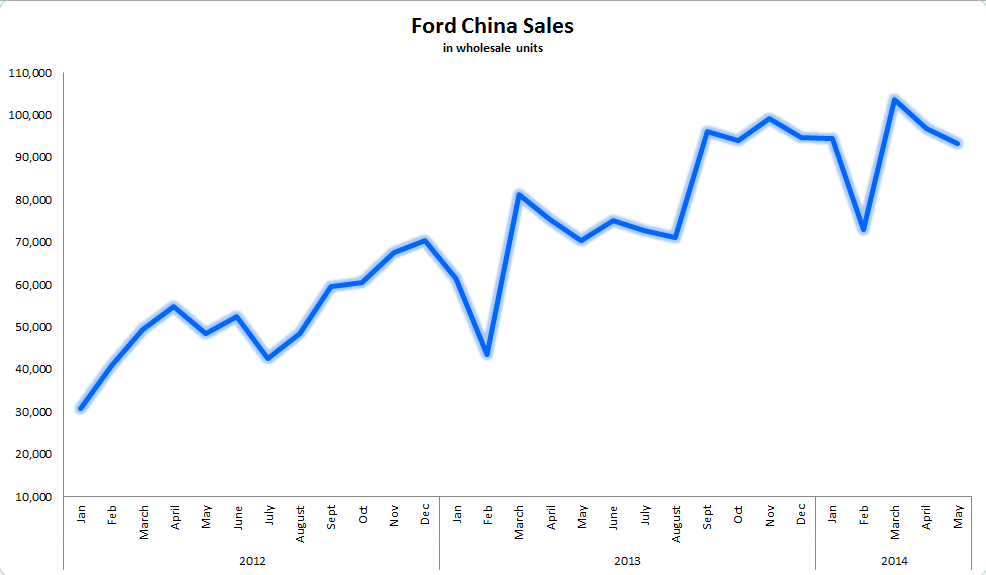

The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. Fact sheets are issued by the ETF provider and framed by ETF Database. Information contained within the fact sheet is not guaranteed to be timely or accurate. The following charts reflect the allocation of

SLV’s

underlying holdings.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Although BlackRock shall obtain data from sources that BlackRock considers reliable, all data contained herein is provided “as is” and BlackRock makes no representation or warranty of any kind, either express or implied, with respect to such data, the timeliness thereof, the results to be obtained by the use thereof or any other matter. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

Historical Prices

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. In the same report you can also find a detailed bonus biotech stock pick that we expect to return more than 50% within months. We initially share this idea in October 2018 and the stock already returned more than 150%. ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style.

As a global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being. Since 1999, we’ve been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. IShares funds are available through online brokerage firms.All iShares ETFs trade commission free online through Fidelity. Share this fund with your financial planner to find out how it can fit in your portfolio. If you want to read our discussion on the silver industry, you can go directly to the 10 Best Silver ETFs. Below is a look at ETFs that currently offer attractive buying opportunities.

Will Silver ETFs Outshine Gold ETFs Ahead? – Yahoo Finance

Will Silver ETFs Outshine Gold ETFs Ahead?.

Posted: Tue, 29 Aug 2023 07:00:00 GMT [source]

The funds described in the following pages can be marketed in certain jurisdictions only. It is your responsibility to be aware of the applicable laws and regulations of your country of residence. Further information is available in the relevant fund’s offering documents.

ETF Database’s Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. For investors in SwitzerlandA Swiss Representative and a Swiss Paying Agent has been appointed pursuant to Art. 120 para 4 and Art. 120 para 2 lit. The Representative of the Fund in Switzerland is BlackRock Asset Management Switzerland Limited.

Gold vs. Silver: Which Precious Metal Should You Invest in Now?

It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. On this website, financial intermediaries are investors that qualify as institutional investors, qualified investor, or professional investors in their respective jurisdiction smart contract dictionary of residence (as such term is defined by the applicable regulations in such relevant jurisdiction), acting as agents on behalf of non-U.S. A popular exchange-traded fund that offers exposure to silver was on pace for its best day in 12 years and its highest close since 2013.

Data may be intentionally delayed pursuant to supplier requirements. Actually Warren Buffett failed to beat the S&P 500 Index in 1958, returned only 40.9% and pocketed 8.7 percentage of it as “fees”. His investors didn’t mind that he underperformed the market in 1958 because he beat the market by a large margin in 1957.

Certain funds may have contractual or voluntary fee waivers that result in a Net Expense Ratio. The MSCI Weighted Average Carbon Intensity measures a fund’s exposure to carbon intensive companies. This figure represents the estimated greenhouse gas emissions per $1 million in sales across the fund’s holdings. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Adverse changes in the economic environment can have a negative impact on the price of silver since it is used in industrial applications.

- Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties (which are expressly disclaimed), nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto.

- Please refer to the MSCI ESG Fund Ratings Methodology for more information.

- He launched his hedge fund in 1956 with $105,100 in seed capital.

- ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, native content channels, and more.

- The screening applied by the fund’s index provider may include revenue thresholds set by the index provider.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Due to lowered expectations for inflation worldwide, the price of silver took a hit, negatively affecting the value of iShares Silver Trust shares. The attitude of speculators and investors matters a lot for the price of silver, especially in short-term horizons. Investors should be especially careful and cognizant of unique risks inherent to investing in silver.

Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Warren Buffett never mentions this but he is one of the first hedge fund managers who unlocked the secrets of successful stock market investing. He launched his hedge fund in 1956 with $105,100 in seed capital. Back then they weren’t called hedge funds, they were called “partnerships”. Warren Buffett took 25% of all returns in excess of 6 percent.

The iShares Silver Trust was up 9.8%, at last check, putting the trust that was crea… If Warren Buffett’s hedge fund didn’t generate any outperformance (i.e. secretly invested like a closet index fund), Warren Buffett would have pocketed a quarter of the 37.4% excess return. The following charts reflect the geographic spread of

SLV’s

underlying holdings.

- Below is a look at ETFs that currently offer attractive buying opportunities.

- Persons, and in compliance with all applicable laws and regulations of the relevant jurisdiction in which such materials will be distributed.

- We initially share this idea in October 2018 and the stock already returned more than 150%.

That year Buffett’s hedge fund returned 10.4% and Buffett took only 1.1 percentage points of that as “fees”. S&P 500 Index lost 10.8% in 1957, so Buffett’s investors actually thrilled to beat the market by 20.1 percentage points in 1957. To obtain a current prospectus for an iShares Index Mutual Fund click here. ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, https://1investing.in/ native content channels, and more. The ETF Trends and ETF Database brands have been trusted amongst advisors, institutional investors, and individual investors for a combined 25 years. The firms are uniquely positioned to aid advisor’s education, adoption, and usage of ETFs, as well as the asset management community’s transition from traditionally analog to digital interactions with the advisor community.

Although the shares of the trust are not a direct substitute for actual silver, they still provide an alternative to participating in the commodities market. The fund offers a convenient way of obtaining exposure to silver without a need on the part of an investor to actually hold silver. Acquiring and storing silver can be very expensive and complicated.

Also, as discretionary consumer spending worldwide falls from a result of shifts in preferences or income decline, spending on jewelry can decrease. As of 2020, looking back over the last five full years, the supply of silver tended to exceed its demand, resulting in downward pressure on the price of silver worldwide. Demand for silver comes primarily from coinage minting and the jewelry industry, as well as the industrial sector, which uses silver to produce photography mirrors and electrical conduction materials. Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the countries in which our funds are authorized for sale.

0 Comments